Encouraging Black Teens to Become Investors

Research by The Pew Research Center reports the following: “White households are much more likely than minority households to own stocks directly or indirectly through retirement accounts. Thus, they were in a better position to benefit from the recovery in financial markets.”

You probably already know this in your gut!

Stock Ownerships by Black Households vs. Whites

Date released by the Federal Reserve(Table 3) shows that while 60.8% of white households own stock (directly or indirectly through retirement programs), only 33.5% of black households have a stake in the stock market.

This means that many African-Americans have missed out on the fantastic growth in the stock market over the past decade. The result is that the racial wealth gap between Whites and Blacks continues to widen.

Reasons for Low Stock Ownership Rates Amongst African-Americans

There are many inter-related reasons why African-Americans lag in stock holdings:

History of racism that blocks them from good paying jobs where they can save and invest in stocks through retirement programs or directly in the stock market; lower income earned by Africa-Americans generally means that they won’t have much money to invest after taking care of their most basic needs.

Lack of stock investment knowledge passed down from generation to generation.

Some African-Americans may prefer to put their money in safer places besides the stock market possibly due to the residual fear and distrust brought about by systematic racism.

Building wealth can take generations – broadly speaking, African-Americans don’t have stocks and other assets handed down to them from prior generations. (See Table 2 in the Federal Reserve report which shows that 29.9% of White families report having received an inheritance or gift, compared to about 10.1% of Black families.)

Stock Ownership is Still One of the Best Ways to Build Wealth

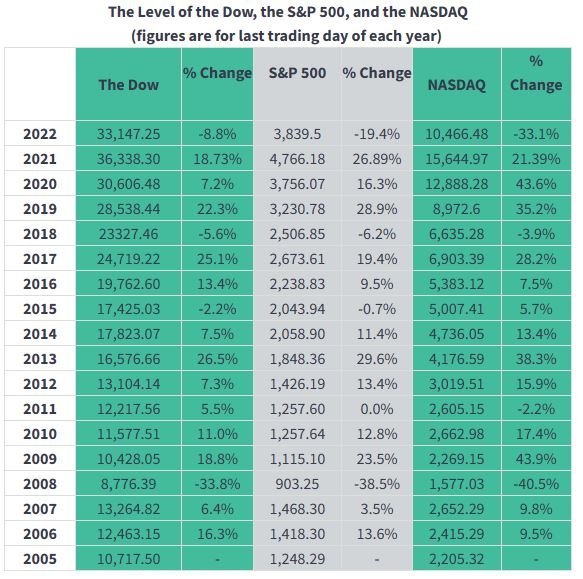

Investing in the stock market is one of the best ways to build wealth. Sure, there are times when the stock market drops dramatically, such as in 2008 when the stock market as measured by the S&P 500 stock market index dropped by 33.8%. (See the orange rectangle in the table below – For a full explanation of stock market indexes, visit: Stock Market Indexes).

However, you can also see in the same table that the stock market had many years of strong performance from 2009 through the end of 2020 (See the black rectangle in the table below).

Estimates vary, but over a long period of time, stock investors can expect a return of 7% or so in the stock market. This may not seem like much but the power of compounding (reinvesting your money over time) can make invested money multiply quickly over time.

Black Parents are Recognizing the Need to Teach Investing

As soon as young Black adults leave the house to go to college or just to live on their own, they are suddenly expected to know how to manage their financial affairs.

The truth is that there are no financial or investment training wheels for them when they finally leave the nest.

Black parents are increasingly recognizing the need to teach their children to be financially literate – especially to learn about investing – while they are still at home.

This was beautifully illustrated in a March 2021 New York Times article about a Black parent gifting her son, Jaydyn Carr (shown in photo below), stock in honor of the Kwanza principle of Ujamaa, or cooperative economics. (Photo below by Nina Carr, courtesy of New York Times).

Photo by Nina Carr (Courtesy of New York Times)

A passage from the article illustrates the current attitude among Black parents about teaching their children to become financially savvy:

“Ms. Carr said she became committed to teaching her son about financial literacy after Jaydyn’s father, an Army combat medic, died in 2014 from combat-related complications. A certificate of deposit she opened with a death compensation payment provided an entry point to teach her son financial responsibility — lessons she said she didn’t learn until later in life.”

Another Black parent got her son investing in the stock market after she herself took a stock investing course. Her son’s investment journey is chronicled in an illuminating Miami Times article.

Image from Miami Times

These articles and many others broadly show how Black parents are now encouraging their children to more actively take part in the stock market.

Investing Has Become a Lot Easier and Cheaper

Over the past few years, investing in the stock market has become a lot easier because trading costs have come down considerably.

There are reputable online brokers that charge no fees to buy and sell stocks for investors.

In addition, investors can now buy fractions of stocks. So, if you can’t afford to put down hundreds of dollars for your favorite stock, you can purchase as little as $5 (or less) of that company’s stock.

This makes the stock market more accessible to young African-American investors.

Plenty of Educational Material Is Available

In addition to lower investing cost, educational material about investing can now be found in many corners of the Internet. Here are three of our sites that can help African-American teens become wise stock investors:

TeenVestor.com – a free site designed for teens interested in investing.

TeenVestor Stock Certification Course – an online course for teen investors.

TeenVestor Stock Game – a free site where teens can create their own dummy stock portfolio and trade with virtual dollars.

Great African-Americans Investors Can Provide Inspiration

Believe it or not, there have been many African-Americans that have made a fortune by either building a business for investing other people’s money or in buying companies that are publicly traded in the US stock market.

None of them were born knowing how to invest or how to make deals that shot them up +the top of the investing food chain.

I’ve listed 3 examples of African-American investors below. Please make sure to look at the video about Reginald F. Lewis.

Founder, Chairman and CEO

Vista Equity Partners, Austin TX

Company Started in 2000

Vista currently manages investment of over $75 billion and oversees a portfolio of more than 60 enterprise software, data and technology-enabled companies that employ over 70,000 people worldwide. Since Vista’s inception, Mr. Smith has supervised over 455 completed transactions representing more than $155 billion in aggregate transaction value. He has a net worth of over $7 billion.

Co-CEO & President

Ariel Investment, Chicago IL

Company Started in 1983

Ariel Investments currently manages about $12 billion in assets. As Co-CEO, Mellody is responsible for management, strategic planning and growth for all areas of Ariel Investments outside of research and portfolio management. Additionally, she serves as Chairman of the Board of Trustees of the Ariel Investment Trust—the company’s publicly traded mutual funds. Prior to being named Co-CEO, Mellody spent nearly two decades as the firm’s President. Outside of Ariel, Mellody is a nationally recognized voice on financial literacy. Her leadership has also been invaluable to corporate boardrooms across the nation. She currently serves as Chair of the Board of Starbucks Corporation.

Reginald F. Lewis (Deceased 1993)

Chairman

TLC Beatrice International, New York NY

Company Started in 1987

Perhaps one of the most significant, iconic African-American financiers over the past 50 to 60 years is Reginald F. Lewis. Mr. Lewis bought Beatrice International Foods for $985 million in 1987, and the company subsequently became the first black-owned company to exceed $1 billion in sales. Unfortunately, he died in 1993 at the age of 50, but African-Americans who wish to operate at the highest level in the financial world should explore his path to success and his philanthropic endeavors. Young African-Americans can read his book, Why Should White Guys Have All the Fun? for inspiration and for courage to overcome obstacles deliberately placed in their path. They should also watch a Public Broadcasting Service (PBS) special about this great African-American man: Reginald F. Lewis and the Making of a Billion Dollar Empire | Pioneers | WLIW21.