TeenVestor.com Survey of Actual Teen Investors

TEENVESTOR SMILING

Summary of the Basis for the Report

This report covers voluntary surveys of 160 teenagers, ages 13 to 18, who took an online course for aspiring teen investors – the TeenVestor Stock Certification Course.

The course consisted of 17 educational modules completed in 8-10 hours by each learner. The students who completed the surveys took the course between Jan. 1, 2021, to Dec. 31, 2021. The results of the two surveys, a pre-course survey and a post-course survey, are discussed in this report. Details of the methodology are available here.

Summary of the Survey Results

We found some interesting results about the aspiring teen investors regarding their interest in learning about balance sheets and income statements; their attitudes about ESG (Environmental, Social, and Governance) concerns; their motivation for wanting to learn how to invest; and demographic information about them. These include the following:

The aspiring young investors are not so ESG-conscious: Making investments that meet a set of moral, ethical, or environmental guiding principles is known as ESG investing or socially responsible investing (SRI); the respondents ranked the socially responsible investing (SRI) module as the least useful topic in their investing journey among 17 educational modules.

The teen investors are not primarily motivated by making lots of money: 68% of the respondents just wanted basic stock investing knowledge and to build long-term investment habits; 19% of the respondents were interested in stocks, it appears, to make easy money.

An investment course made the students more likely to invest in stocks: 91% of the respondents said that taking the stock investment course made them “totally” or “most likely” to invest in stocks.

67% of the respondents do not attend schools with investment or business classes.

The following sections review the course surveys in more details.

1) What the Teen Learners Expected to Get Out of the Course

Teens who paid for the online stock course were asked about what they expected to get out of it. Specifically, the question was as follows:

What are you hoping to get out of this course?

Respondents were asked to respond in a free-form manner. The responses were generally one sentence long.

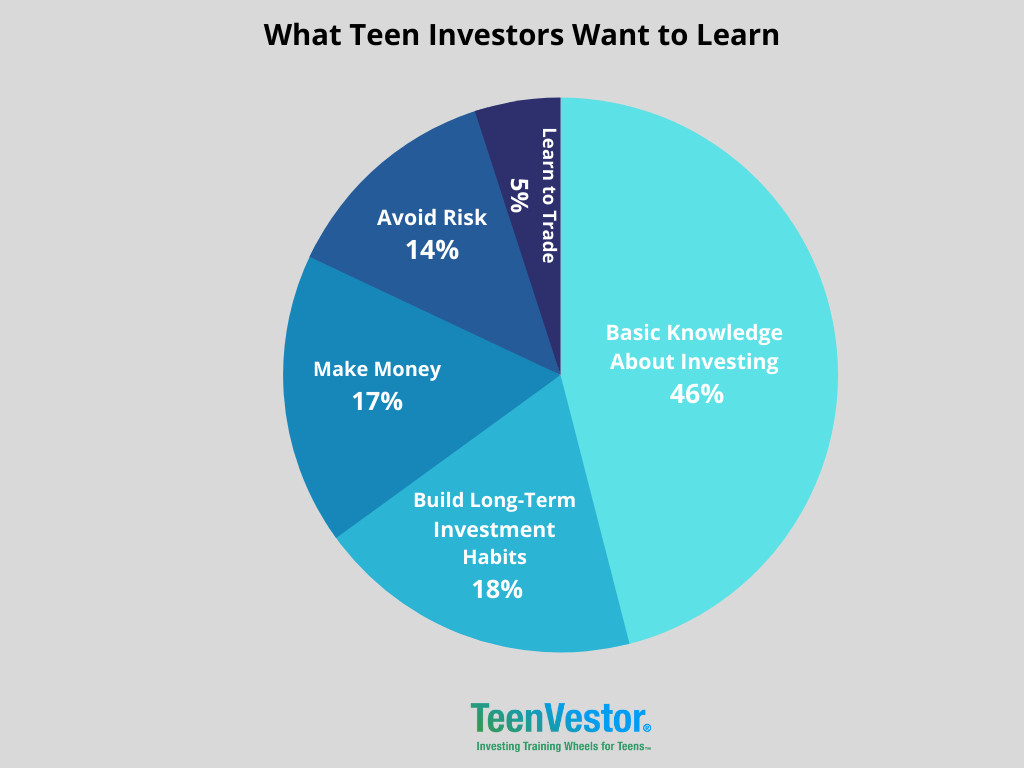

We reviewed each of the 160 statements from the teen learners and put each into six broad categories shown in Exhibit 1 below.

We categorized by the overwhelming sentiment in each respondent’s sentence.

Exhibit 1: What are You Hoping to Get Out of this Course?

Results Analysis & Our Views

We asked this question to understand the expectations of the aspiring investors. We were expecting a substantial number of the students to say that they were motivated to take the course to make a lot of money in the stock market. However, the explicit desire to make money ranked 3rd as the motivation for taking the course at 17% of the teen learners.

The top response (46% of all students who completed the pre-course survey) referenced seeking investing knowledge in the broader sense, without mentioning getting rich through the stock market or references to making fast money. We categorized this as: Seek Basic Knowledge About Investing in Stocks. Examples of the responses in this category included the following:

“I hope to gain some knowledge on investing stocks so I can start investing soon, as a teenager”

“Basic understanding of the stock market”

“Expand my knowledge on investments”

“I'm hoping to learn to successfully invest on my own”

The second most popular response was a bit surprising – Build Long-Term Investing Habits for the Future (18%). This was a fascinating result because it spoke to the teens’ explicit desire to look to the future and/or invest over their lifetime. Examples of the responses in this category included the following:

“I hope to gain a better understanding of the stock market and how to strategically invest money to build long term wealth and habits”

“Something that helps me move forward to plan my life in an efficient way”

“I want to learn how to invest so I can be smart with my money in the future”

The third most popular response was: Make/Grow/Handle Money (17%) – just 1% below the next higher category, Build Long-Term Investing Habits for the Future (18%). As mentioned earlier, the statements made by the teen learners were put into this category if they reference making money, especially fast money, in the stock market. Examples of the responses in this category included the following:

“Money”

“Learn how to be a master in making and investing money”

“Learn about how to make money from stocks at a young age and to have money to pay for college”

“Money and a financial option for the future”

The fourth most popular response was: Learn to Avoid Risk & Invest Responsibly (14%). This was a pleasant surprise because excessive risk taking is a real concern for adult investors who feel that young investors who perhaps have not gone through a severe market downturn in their lifetime. Some of them may be under the impression that the stock market will keep going up so it is good that there are a few teen investors that are concerned about avoiding risk. Examples of the responses in this category included the following:

“I am hoping to learn how to make money with less risk”

“Knowledge about investing so I don't make mistakes and minimize my losses”

“Be able to make good investing choices and learn how to properly use my money”

“Learn how to make intelligent stock investments”

The fifth most popular response was: Learn How to Trade (5%). There were very few responses in this category. Examples of the responses in this category included the following:

“I am hoping to understand stocks and how to trade, sell them and build up my knowledge of it”

“I am hoping to be able to get enough understanding of stocks to be able to run my own stock slices and paper trading accounts”

"To learn how the stock market works and how to start trading”

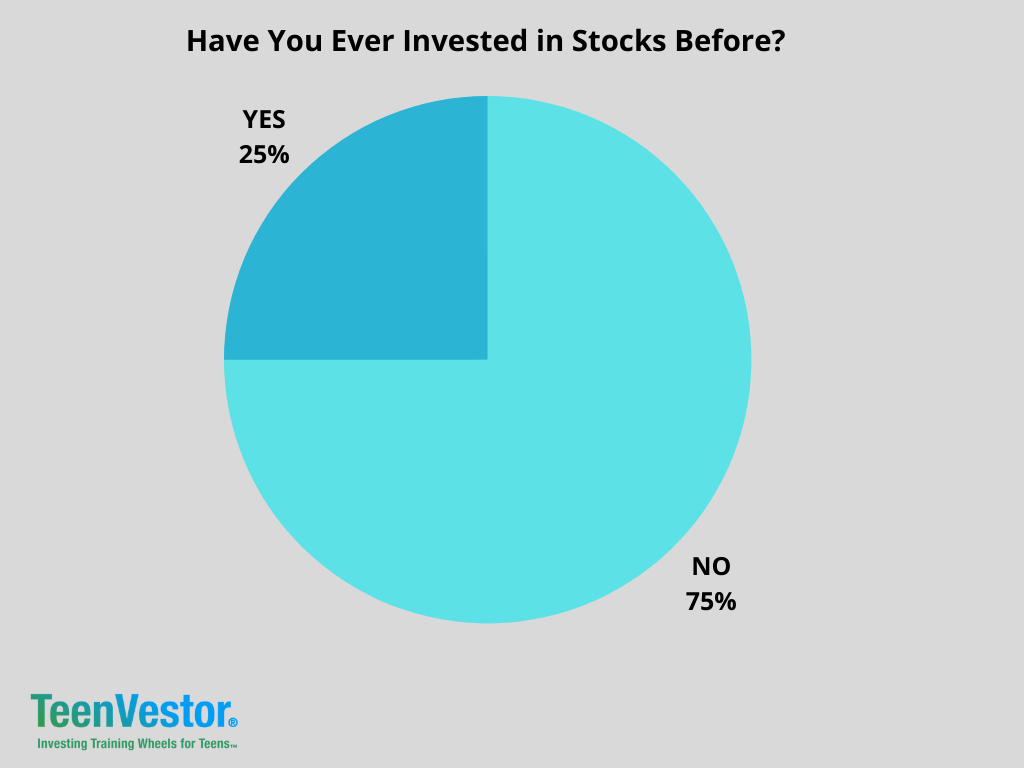

2) The Teens’ Prior Investment History

We asked about their prior investment history to understand the motivation of the 160 teen learners who took the stock investing course. Specifically, the question was as follows:

Have you ever invested in stocks before?

The answer choices were:

Yes

No

Exhibit 2 shows that only 25% of the learners had invested in stocks, and 75% had not.

Results Analysis & Our Views

We asked this question to get a baseline of the teen learners who signed up for the course. We expected that the overwhelming majority of the students would be new to investing because the course is for beginning investors. The results confirmed our thoughts on this.

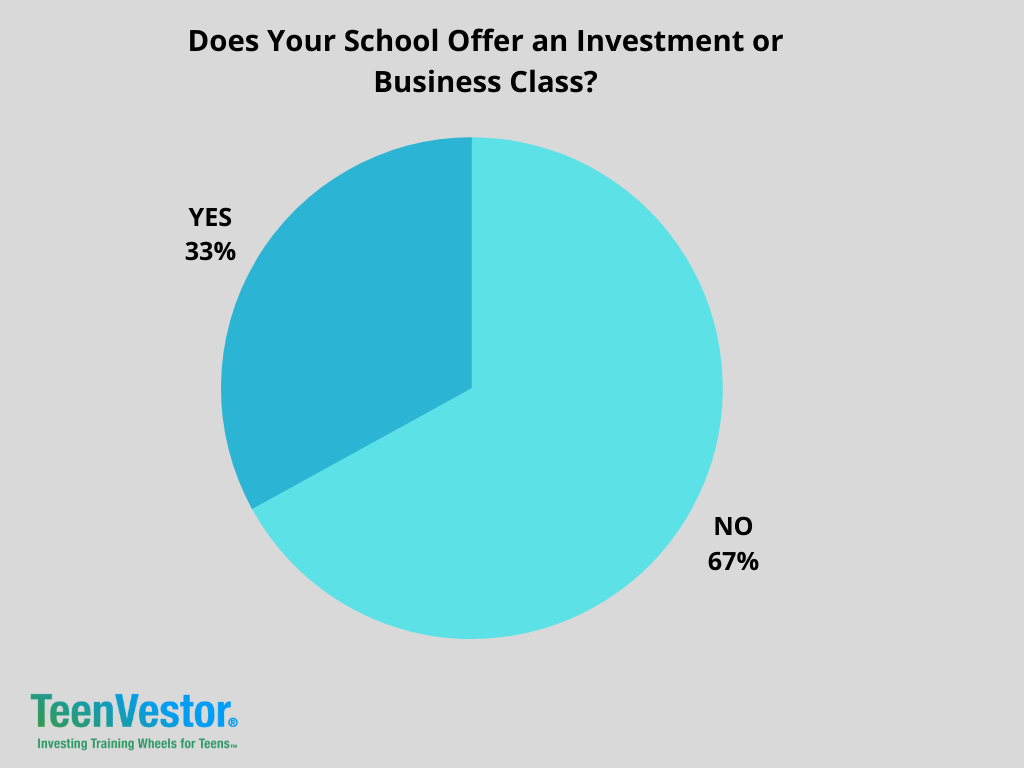

3) Whether the Teens’ Schools Offer Investment or Business Courses

The survey asked the teen learners whether their schools offer an investment or business class: Specifically, the question was as follows:

If you have not yet graduated from high school, please let us know if your school offers an investment or business class. (Choose the Best Answer).

The answer choices were:

Yes

No

The graph in Exhibit 3 shows that only 33% of the learners have an investment or business class in their schools, while 67% do not.

Exhibit 3: Does Your School Offer an Investment or Business Class?

Results Analysis & Our Views

We asked this question to discover whether the teen learners’ schools offer an investment or business class. Unfortunately, we did not go further to ask whether the teens ever took any of those classes. Nevertheless, this helped us form ideas about the demographics of the student who signed up and paid for the TeenVestor Stock Certification Course.

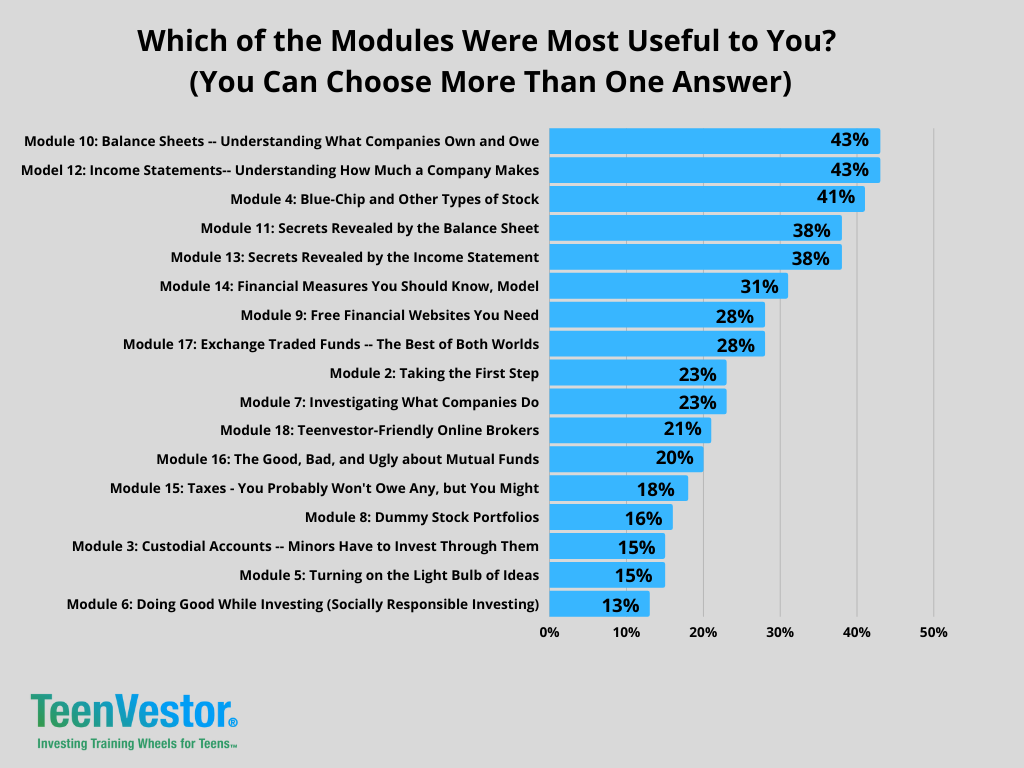

4) Top Modules of Interest

We asked teens that took the stock investment course to list which modules were most useful to them. The exact question was as follows:

Which of the modules were most useful to you? (You Can Choose More Than One Answer)

The respondents could choose more than one answer in each category, so the summation of the percentage scores will exceed 100%. The order of the most useful modules is shown in Exhibit 4.

Exhibit 4: Which of the Modules Were Most Useful to You?

Results Analysis & Our Views

The learners’ choices gave us great insight into the subject teens are interested in exploring in an investment course. The top modules relate to understanding and exploring balance sheets, income statements, and categories of stocks such as blue-chip, growth, cyclical, interest-rate sensitive stocks. Specifically, the top 8 modules (approximately half of the 17 educational modules in the course) were as follows:

Module 10: Balance Sheets -- Understanding What Companies Own and Owe - (43%)

Model 12: Income Statements-- Understanding How Much a Company Makes - (43%)

Module 4: Blue-Chip and Other Types of Stock - (41%)

Module 11: Secrets Revealed by the Balance Sheet - (38%)

Module 13: Secrets Revealed by the Income Statement - (38%)

Module 14: Financial Measures You Should Know, Model - (31%)

Module 9: Free Financial Websites You Need - (28%)

Module 17: Exchange Traded Funds -- The Best of Both Worlds - (28%)

The modules on the list above do not suggest that the other modules are unimportant. However, they indicate that a stock investment course should probably concentrate on the most important topics, especially if the students have a limited time for the course. For example, perhaps explaining taxes should be given less attention in the course since teen learners mostly want to know the basics of investing first.

We were surprised that the young learners identified Module 6: Doing Good While Investing (Socially Responsible Investing) as last in the full list of most useful modules, as shown in Exhibit 4. Making investments that meet a set of moral, ethical, or environmental guiding principles is known as ESG investing or socially responsible investing (SRI). ESG-conscious investing has been gaining popularity amongst the broader investor community.

We will discuss ESG-conscious investing further in the next survey question in which we asked the students to list their least useful modules.

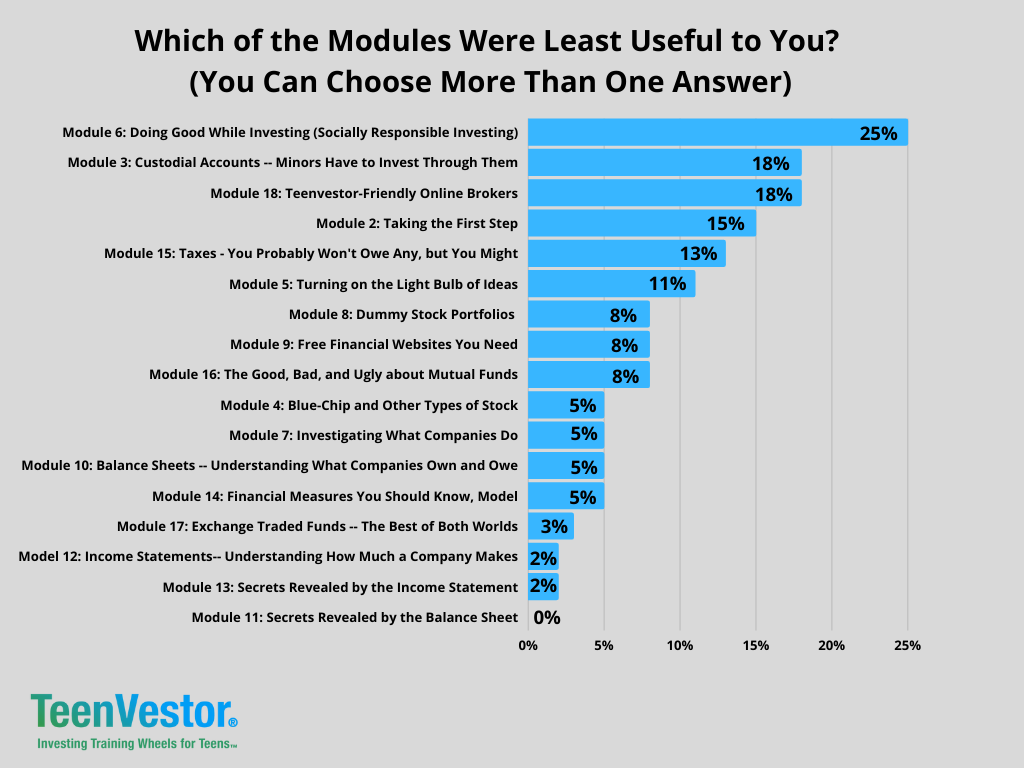

5) The Least Useful Modules

We asked teens who took the stock investment course to list which modules were least useful to them. The exact question was as follows:

Which of the modules were least useful to you? (You Can Choose More Than One Answer)

The respondents were allowed to choose more than one answer in each category, so the summation of the percentage scores will exceed 100%. The order of the least useful modules is shown in Exhibit 5.

Exhibit 5: Which of the Modules Were Least Useful to You?

Results Analysis & Our Views

The respondents gave us great insight into the subjects they thought were least useful. The top items on this list do not necessarily teach the young invest concrete stock investing skills. Specifically, the top 9 modules (approximately half of the 17 educational modules in the course) were as follows:

Module 6: Doing Good While Investing (Socially Responsible Investing) – 25%

Module 3: Custodial Accounts -- Minors Have to Invest Through Them – 18%

Module 18: Teenvestor-Friendly Online Brokers – 18%

Module 2: Taking the First Step – 15%

Module 15: Taxes - You Probably Won't Owe Any, but You Might – 13%

Module 5: Turning on the Light Bulb of Ideas – 11%

Module 8: Dummy Stock Portfolios – 8%

Module 9: Free Financial Websites You Need – 8%

Module 16: The Good, Bad, and Ugly about Mutual Funds – 8%

The modules on the list above do not suggest that the topics are absolutely unimportant. However, they do suggest that we should think carefully about whether to scale back or de-emphasize some of the subjects on the list.

Comparing the list of the most useful modules (Exhibit 4) to the list of the least useful modules (Exhibit 5), we find what the two lists have "in common" – Module 6: Doing Good While Investing (Socially Responsible Investing), the ESG-investing module.

This module ranks last in the list of most useful modules (Exhibit 4) and first in the list of least useful modules (Exhibit 5), which implies that the teen learners are not enthusiastic about ESG investing.

Over the years, we’ve been told that young people are especially interested in ESG-related investing because of their heightened social consciousness and environmental concerns. However, when young people who are either investors or are serious about investing (as demonstrated by paying a substantial amount for the course) are surveyed, the results appear different from conventional wisdom.

This is not to say that teen investors don’t care about issues related to the environment or social justice in other parts of their lives outside of the stock market. In addition, it does not mean that the general population of teenagers is not concerned about those issues. It merely suggests that the primary interest of the subset of active and aspiring teen investors (at this point of their investing journey) is not ESG-influenced investing but learning investing basics.

Other variables may come into play, affecting the responses and their statistical significance, such as 1) how well the module explained ESG investing and 2) the relatively small sample of 61 teen learners who completed this specific survey question.

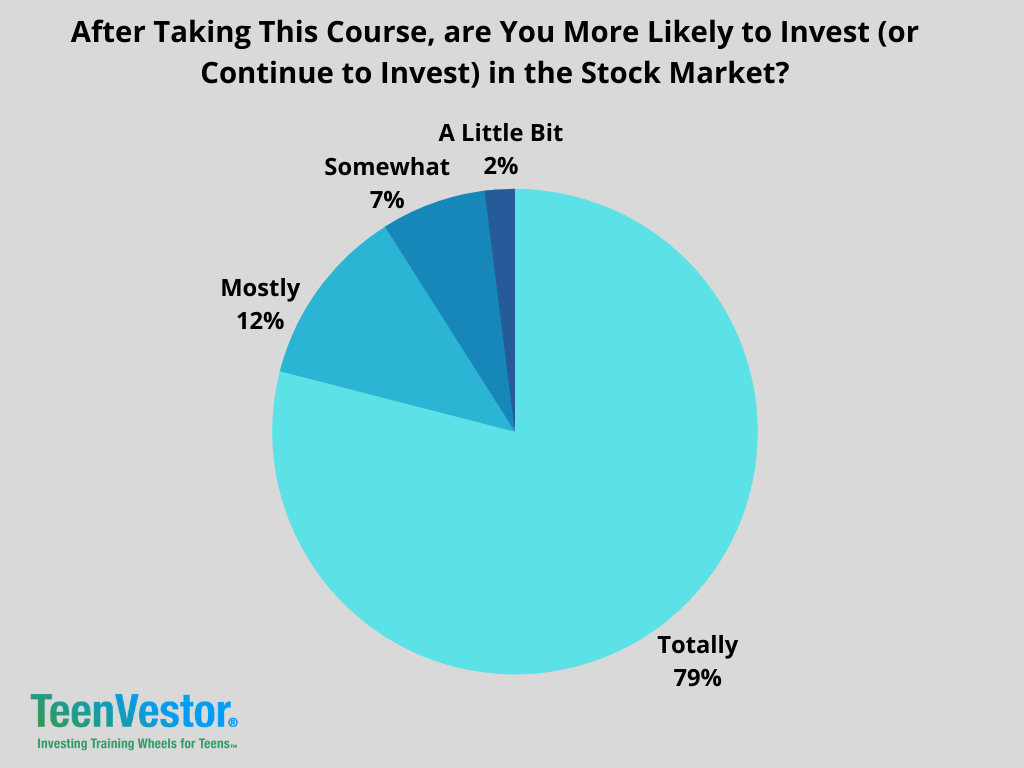

6) The Effect of Taking an Investment Course

To gauge whether taking an investment course will drive the teen learners to either continue investing or begin investing in the stock market. The exact question was as follows:

After taking this course, are you more likely to invest (or continue to invest) in the stock market?

The answer options were as follows:

Totally

Mostly

Somewhat

A Little bit

Not at All

The graph below shows that 92% of the teen respondents say they are totally likely or most likely to invest in stocks after taking the course. See Exhibit 6 below for the effect of the teens taking the investment course.

Exhibit 6: After Taking the Course, Are You More Likely to Invest in the Stock Market?

Results Analysis & Our Views

We were not surprised that 92% of the teen respondents say that they are totally likely or most likely to invest in stocks after taking the course. It is clear that a little bit of information to potential young investors goes a long way towards getting them more interested in investing. Our goal was not to inundate them with useless jargon and too many details about investing in stocks. The basics are all they require to get them started.

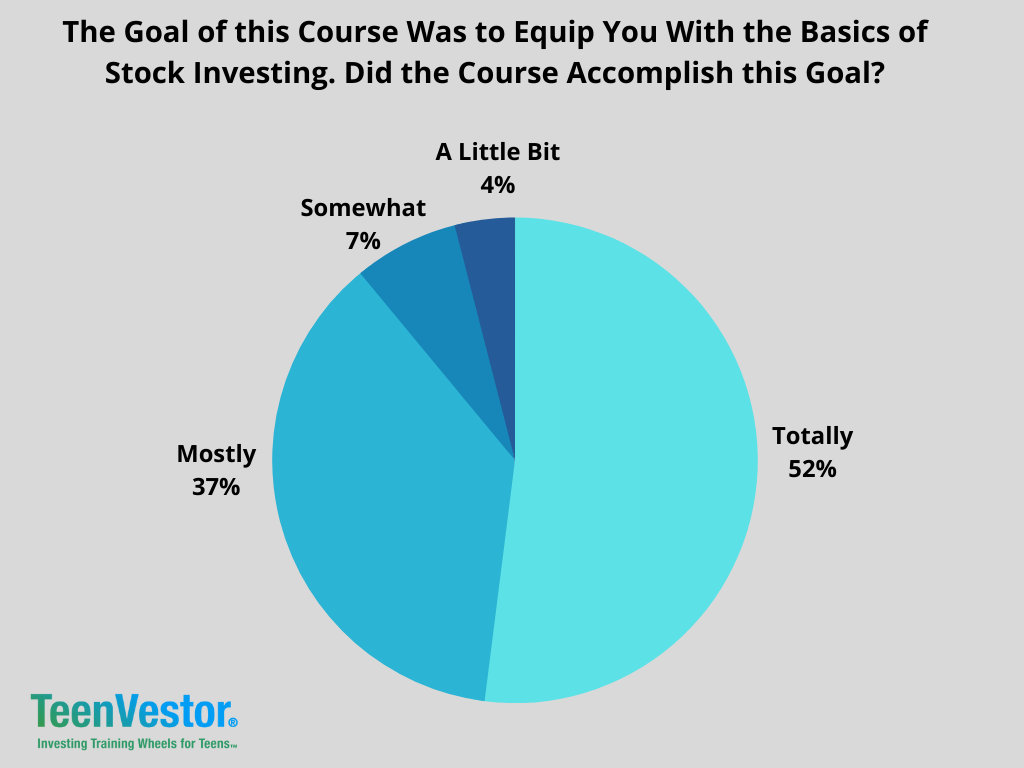

7) The Extent to Which the Course Met Its Goal

In order to gauge whether the teen learners felt the course met its goal, we asked the following question:

The goal for this course was to equip you with the basics of stock investing. Did the course accomplish this goal?

The answer options were as follows:

Totally

Mostly

Somewhat

A Little bit

Not at All

The graph below shows that about 90% of the teen respondents felt that the course totally or mostly met its goals of teaching learners the basics of stock investing. See Exhibit 7 below about whether the course met its stated goal.

Exhibit 7: The Extent to Which the Course Met Its Goal

Results Analysis & Our Views

We were not surprised that about 90% of the teen respondents say that they are totally likely or most likely to invest in stocks after taking the course. Once again, our goal was not to inundate them with useless jargon and too many details about investing. We will use the results of the surveys to improve the course so as to increase this score.

8) Satisfaction with the Course

In order to gauge whether the teen learners were satisfied with the course, we asked the following question:

How satisfied were you with this online course?

The answer options were as follows:

Totally

Mostly

Somewhat

A Little bit

Not at All

The graph below shows that 92% of the teen respondents were either totally satisfied or mostly satisfied with the online stock course. See Exhibit 8 below for the level of satisfaction with the investment course.

Exhibit 8: How Satisfied Were You With this Online Course?

Methodology of the Survey

This report covers voluntary surveys of 160 13-18 year old teens who took an online course for aspiring teen investors – the TeenVestor Stock Certification Course. The students who filled out the surveys took the course between Jan. 1, 2021, to Dec. 31, 2021.

The students (actually, their parents) paid between $200 - $300 for the online course so these were highly motivated learners. They took the course at their own pace but overall, it took each students a total of 8-10 hours to complete it.

The Modules

TeenVestor Stock Certification Course consists of 17 education modules at that time, consisting of video, voice and text lessons. The modules also include quizzes designed to test the students’ knowledge. The educational modules covers a broad range of topics related to stock investing as shown below:

Module 1: Introduction (Non-educational)

Module 2: Taking the First Step

Module 3: Custodial Accounts -- Minors Have to Invest Through Them

Module 4: Blue-Chip and Other Types of Stock

Module 5: Turning on the Light Bulb of Ideas

Module 6: Doing Good While Investing (Socially Responsible Investing)

Module 7: Investigating What Companies Do

Module 8: Dummy Stock Portfolios

Module 9: Free Financial Websites You Need

Module 10: Balance Sheets -- Understanding What Companies Own and Owe

Module 11: Secrets Revealed by the Balance Sheet

Model 12: Income Statements-- Understanding How Much a Company Makes

Module 13: Secrets Revealed by the Income Statement

Module 14: Financial Measures You Should Know, Model

Module 15: Taxes - You Probably Won't Owe Any, but You Might

Module 16: The Good, Bad, and Ugly about Mutual Funds

Module 17: Exchange Traded Funds -- The Best of Both Worlds

Module 18: Teenvestor-Friendly Online Brokers

The Pre-Course and Post-Course Surveys

The course contained two voluntary surveys: a pre-course survey and a post-course survey.

The voluntary pre-course survey was completed by one hundred sixty students before they went through the course modules. This survey was broadly designed to discover:

What the young learners expect to get out of the course;

Whether they have ever invested in stocks before taking the course; and

If investment courses are available at their schools.

The voluntary post-course survey was completed by sixty-one students after they went through the course modules. All of the students who took the post-course survey also took the pre-course survey. This survey was broadly designed to discover:

What modules were most and least valuable to the learners;

Whether taking an investment course made them more likely to invest in the stock market; and

The level of the learners’ satisfaction with the course.